ABOUT IPX CAPITAL

A leading private equity investment firm in consumer

products, media & entertainment and real estate.

ABOUT US

IPX Capital is a provider of capital to companies in the consumer products, media & entertainment and real estate businesses. In 2006, the company was acquired by a public holding company. In 2008, the team spun out to become an independent firm known as IPX Capital. Over the years, this team has invested in over 30 consumer products companies and 2,000 residential multi-family housing units. IPX Capital and its predecessor companies, all founded by Robert D’Loren, have led over $3 billion in transaction values over the past 30 years.

IPX Capital and its predecessor companies have partnered with Prudential Securities, GE Capital, Deutsche Bank and co-invested with New York Life, Pacific Life, Prudential Insurance and others. IPX Capital invests in consumer branded products and media & entertainment companies that are positioned to capitalize on the convergence of shopping, entertainment and social media and real estate companies with a successful track record in development and repositioning properties.

EXECUTIVE LEADERSHIP

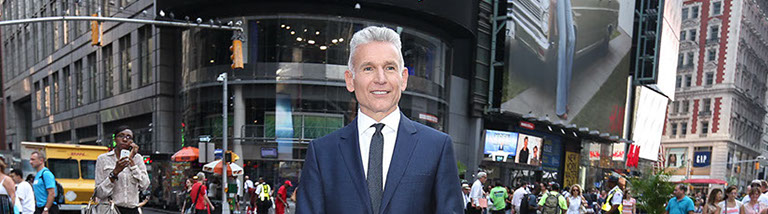

Robert W. D'loren

Chairman and CEO

Bob D’Loren has a successful entrepreneurial track record that spans nearly four decades in multiple sectors. He has built three, and approaching four, companies from $0 to $1 billion. He is a two time recipient of Wall Street’s “Dealmaker of the Year” awards including one by the Executive Council of New York – TenAwards. Bob’s total career debt and equity investments in over 30 entertainment & media and consumer products companies exceeds $1 billion.

Today, as Chairman and CEO of Xcel Brands, Bob D’Loren is disrupting an industry that is ripe for change, and in doing so, is changing the way retail does business. Bob spearheaded its unique omnichannel platform, connecting the channels of digital, bricks & mortar, social media and interactive television to create a single customer view and brand experience for Xcel’s brands.

Prior to forming Xcel Brands and IPX Capital, Bob was the Founder, President and CEO of NexCen Brands, a global consumer products holding company that owned 9 companies with operations in 45 countries. These companies included: The Athlete’s Foot, The Shoe Box, Waverly Home, Bill Blass, Maggie Moo’s, Marble Slab Creamery, Pretzel Time, Pretzelmaker and Great American Cookie Company. Total annual retail sales exceeded $1 billion.

Bob D’Loren’s visionary work among consumer products companies includes the recapitalization and restructure of Candies Shoes, Inc. and subsequent formation and rebranding into Iconix Brand Group, Inc. Some but not all of the Iconix Brand Group, Inc. brands included: Candies, Bongo, Joe Boxer, Badgley Mischka, Rampage, MUDD and Mossimo. Total annual retail sales exceeded $1.5 billion.

In 1998, he founded CAK-Universal Credit Corporation with Prudential Securities, acquired it in 2002 and rebranded it UCC Capital Corporation where he pioneered unique structured financing techniques for intellectual property centric companies that included media, entertainment and consumer products, earning critical acclaim for innovation and best in industry awards.

His early entrepreneurship role began in 1985 as founder, President and CEO of the D’Loren Organization, an investment and advisory firm responsible for over $2 billion in transactions. As a real estate investor, Bob D’Loren has acquired, managed and/or invested in over 2,000 units of residential multifamily housing and advised clients including but not limited to the FDIC, Fannie Mae, Freddie Mac, The Resolution Trust, HUD and other quasi-public corporations, government agencies and banks. He has also served as an asset manager for Fosterlane Management as well as a manager with Deloitte.

Bob D’Loren has been lauded for his leadership and innovation across industries as well as for his work as a humanitarian. He has served on the Board of Directors for Iconix Brand Group, Inc., NexCen Brands, Longaberger Company, Business Loan Center and Xcel Brands. Among his charitable initiatives, he has served as Board director for Achilles International. Mr. D’Loren is a Certified Public Accountant and holds an M.S. from Columbia University and a B.S. from New York University. To learn more, visit www.rdloren.com.

In addition to Mr. D’Loren, IPX Capital is composed of highly seasoned professionals who have a deep expertise in investment banking, private equity, consumer products, media, entertainment and real estate.

Advisor Support

Our advisors include a unique executive bench of leaders in consumer brands, media & entertainment and real estate, with skill sets that encompass:

- Branding, marketing and media

- Production, design and merchandising

- Ecommerce and social commerce

- Supply chain management

- IP monetization and licensing

- Real estate optimization

- Mergers and acquisitions

Learn about IPX CAPital's investments